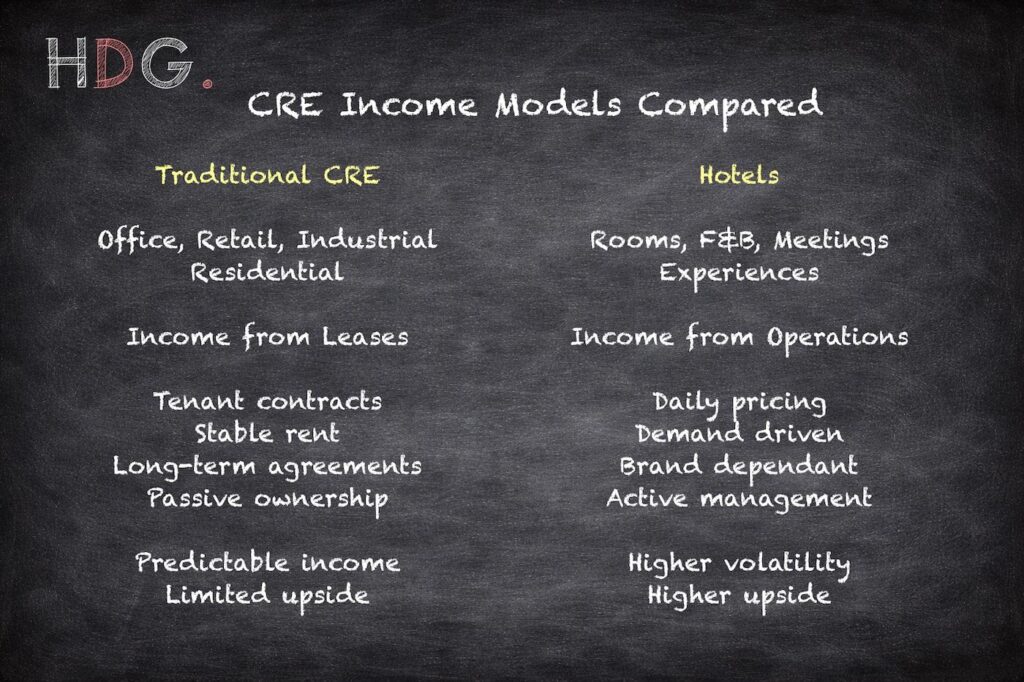

Commercial real estate (CRE) is commonly divided into several major sectors, including office, retail, industrial and residential property. The comparison of hotels vs CRE sectors highlights an important distinction: while hotels are sometimes grouped within this framework, they behave very differently from most traditional CRE assets. Unlike the leased property sector, where income is typically secured through long-term tenant contracts, hotels operate as trading businesses, with revenue fluctuating daily based on occupancy, pricing and demand.

Understanding hotels vs CRE sectors is therefore essential for investors and developers evaluating where hospitality fits within the wider real estate landscape. While offices, retail units, warehouses and residential buildings rely primarily on rental income and tenant stability, hotels generate revenue through active operations, brand positioning and market demand cycles.

This page compares hotels with the main commercial real estate sectors: office, retail, industrial and residential, highlighting the key structural differences in development, investment risk, income stability and operational complexity. These comparisons help explain why hotels are sometimes misunderstood within the CRE universe and why they require a different investment perspective.

Hotels vs CRE Sectors – Table of Contents

The Commercial Real Estate (CRE) Segment

Commercial real estate (CRE) is commonly divided into four primary subsectors: office, retail, industrial and residential property. These sectors form the foundation of most real estate investment markets and are typically characterised by income generated through tenant leases and relatively predictable rental cash flows. Because of their scale and transaction frequency, they also serve as the primary benchmarks for investors, lenders and valuers when assessing real estate assets.

Hotels are sometimes included as a fifth CRE sector, although their classification varies by market. In some investment frameworks, they are grouped alongside other specialised property types such as hospitals, care housing, leisure facilities or parking assets. Unlike traditional CRE sectors, however, hotels do not normally rely on long-term tenant leases. Instead, they operate as revenue-generating businesses within real estate, with income driven by daily demand, pricing and operational performance. This fundamental difference explains why hotels are often analysed separately from other commercial property sectors.

Office Property

Characteristics of Office Real Estate

Office real estate is primarily driven by economic activity in major business centres and commercial districts. Demand for office space grows alongside employment in sectors such as finance, professional services, technology, consulting, and government administration. Office buildings are typically concentrated in central business districts or in planned business parks where infrastructure, transport access and professional clustering create a strong commercial ecosystem.

Office CRE is characterised by the following:

- High project value and profile as are often large build volume in prime CBD

- An appreciable amount of transactions

- Typically, tenants provide their office fit-outs

- Prolonged low vacancy creates elevated rental rates and high profitability

- Variable returns are sensitive to macroeconomic performance

- It can be dependent on one or a few main office tenants

- Co-working space trends may be disruptive but, conversely, could also create new opportunities for developers

Office investments are generally structured around long-term lease agreements with corporate tenants. These leases provide relatively predictable income streams and allow investors to value properties based on contracted rental cash flow. In many markets tenants contribute to their own internal fit-out, reducing the developer’s initial capital burden. Because office buildings can accommodate multiple tenants of different sizes, investors often view the sector as a balance between income stability and manageable operational complexity.

Office vs Hotel

While both offices and hotels occupy prominent urban locations and can require substantial development capital, their operating models differ fundamentally. Office buildings generate income through long-term lease agreements where rent is fixed for extended periods, often five to fifteen years. Hotels, by contrast, generate revenue through short-term occupancy, with room rates adjusting daily according to market demand, seasonality and pricing strategy.

This difference means that offices behave more like traditional passive real estate assets, whereas hotels function as operating businesses within real estate. Office income stability can make financing easier, particularly where pre-lease agreements are secured before construction. Hotels require more sophisticated demand forecasting and active operational management, but they also have the potential to increase revenues quickly when market conditions strengthen.

Why Developers Often Prefer Offices Over Hotels

Developers frequently favour office projects because the financial structure is easier to underwrite. When a building is pre-leased or partially pre-leased, lenders can rely on contracted rental income to support financing decisions. This reduces development risk and provides a clear valuation framework based on rental yield and lease terms. As a result, office projects can often reach financial close earlier than hotel developments of similar scale.

Hotels, on the other hand, involve greater operational complexity and uncertainty. Revenue performance depends on demand drivers such as tourism, corporate travel, and broader economic cycles rather than long-term lease agreements. Although successful hotels can outperform traditional office CRE in strong markets, developers must evaluate brand positioning, operating agreements, management expertise and market demand in much greater detail before committing to a project.

Retail Property

Characteristics of Retail Real Estate

Retail real estate encompasses a wide spectrum of property types, including large enclosed shopping centres, retail parks, high-street storefronts and mixed-use commercial complexes. Retail demand is closely linked to population density, disposable income and the purchasing behaviour of local consumers. Successful retail environments rely heavily on visibility, accessibility and tenant mix, with anchor tenants often serving as the primary drivers of foot traffic.

Retail CRE is characterised by the following:

- Traditionally, longer leases and relatively stable lease incomes

- Highest per square metre CRE rental values

- Strong growth demand when incomes are rising

- Often dependent on the anchor tenant

- Growth in destination and experiential retail mixing retail with leisure

- Susceptible to changing consumer tastes such as out-of-town developments, delivery services and online retail

Retail investments are typically structured around long-term lease agreements with retailers that pay rent based on fixed terms, sometimes combined with turnover-based rent components. Prime retail locations often command some of the highest rental values in commercial real estate because of their exposure to large consumer flows. However, retail property performance is also closely tied to changing consumer preferences and the broader evolution of shopping patterns.

Retail vs Hotel

Retail and hotel developments share certain similarities in their reliance on location and customer experience. Both sectors depend heavily on visibility, accessibility and the ability to attract consistent visitor flows. However, their revenue structures differ significantly. Retail properties generate income primarily through lease agreements with tenants, while hotels generate income directly from guests through room sales, food and beverage services and other operating revenues.

In retail developments, tenants typically invest in their own interior fit-outs and assume responsibility for day-to-day operations of their individual units. Hotels, by contrast, operate as unified businesses where the owner or operator manages all guest services, staffing, and operational systems. This centralised operational structure means that hotel performance depends not only on location but also on brand strength, operational quality and revenue management.

Structural Risks in Retail Compared to Hotels

Retail real estate faces structural challenges that have become more visible in recent years. The growth of e-commerce and delivery platforms has fundamentally changed consumer behaviour, reducing demand for certain traditional retail formats while increasing demand for experiential retail environments. Shopping centres that rely heavily on a limited number of anchor tenants may experience significant declines in foot traffic if those anchors relocate or close.

Hotels are not immune to structural change, but their demand drivers are more diversified. Tourism growth, corporate travel, conferences and leisure experiences all contribute to hotel occupancy levels. While retail properties depend heavily on retail tenant stability, hotels maintain direct control over pricing and revenue generation. This operational flexibility allows hotels to adjust to market changes more quickly than many retail assets.

Industrial Property

Characteristics of Industrial Real Estate

Industrial real estate includes warehouses, logistics centres, distribution facilities and light manufacturing buildings. These properties are typically located in industrial zones near major transportation corridors such as highways, ports, rail terminals or airports. Industrial developments prioritise functional design features such as loading docks, ceiling heights, storage capacity and efficient distribution layouts.

Industrial CRE is characterised by the following:

- Generally, they require smaller investments

- Less management intensive

- Lower operating costs than office and retail

- E-commerce growth drives warehousing, distribution and fulfilment demand

- Functionality is often specific but usually flexible, as a unit is often an open internal structure

- Low-profile secondary locations requiring large land plots

Compared with other commercial property sectors, industrial real estate often requires lower construction costs and simpler building structures. Operating expenses are generally lower, and management requirements tend to be less intensive. Demand for industrial property is closely linked to economic production, supply chain logistics and, increasingly, the rapid expansion of e-commerce fulfilment networks.

Industrial vs Hotel

Industrial properties differ significantly from hotels in both development structure and operational requirements. Industrial buildings are usually designed for functional efficiency rather than customer experience, and tenants often lease entire facilities under long-term agreements. This structure provides predictable rental income and relatively low operational involvement from the owner once the building is leased.

Hotels operate under a fundamentally different model. Instead of leasing space to tenants, hotels generate revenue through active operations involving accommodation, services and hospitality experiences. While industrial properties function primarily as infrastructure supporting supply chains, hotels depend on guest demand, service quality and brand reputation. As a result, hotel investments require significantly more operational oversight and specialised management expertise.

Why Industrial Real Estate Has Become a Defensive CRE Asset

In recent years, industrial real estate has gained a reputation as one of the more resilient commercial property sectors. The rapid growth of online retail and global logistics networks has increased demand for warehouse and distribution facilities in many markets. This demand has supported strong occupancy levels and relatively stable rental growth in well-located industrial properties.

For investors seeking predictable income streams, industrial assets offer relatively straightforward investment structures and lower operational complexity compared with hospitality properties. Hotels can deliver higher revenue potential during periods of strong travel demand, but their performance is more sensitive to economic cycles and fluctuations in tourism activity. Industrial assets, therefore, appeal to investors prioritising long-term income stability over operational upside.

Residential Property

Characteristics of Residential Real Estate

Residential real estate includes apartment buildings, multi-family housing developments and other properties designed for long-term habitation. Demand for residential property is driven primarily by population growth, urbanisation and housing affordability. Because housing fulfils a fundamental human need, residential real estate typically maintains underlying demand even during periods of economic uncertainty.

Residential CRE is characterised by the following:

- Physiological human needs and, therefore, always an underlying demand

- Individuals, especially families, tend to stay in the same residence for the long term

- Relatively small units and the loss of a single tenant have minimal impact compared to other CRE

- Availability of government-supported financing

- Individual tenant rights under the law make recovery of property difficult even if the tenant breaks the lease terms.

- Recovery of bad debt or costs for damage challenging from private individuals

Residential properties are often divided into multiple smaller units occupied by individual tenants or owners. Rental income is generated through lease agreements with private individuals, and in some markets residential developments may also be sold as individual units under condominium or strata ownership structures. Compared with other commercial property sectors, the loss of a single tenant usually has a limited financial impact because income is spread across many units.

Residential vs Hotel

Residential and hotel developments share certain similarities in their building structures, particularly where both consist of multiple small accommodation units within a single property. However, the nature of occupancy differs significantly. Residential tenants typically remain in place for extended periods under lease agreements that prioritise stability and legal tenant protections.

Hotels operate under short-term occupancy models where rooms are rented nightly rather than monthly or annually. This creates a much more dynamic revenue environment in which income fluctuates daily based on demand, pricing and occupancy levels. While residential properties provide relatively stable income streams, hotels have the ability to capture higher revenues during peak demand periods but must also manage operational volatility.

Residential Development vs Hotel Development

Residential development projects often benefit from financing structures that allow developers to pre-sell individual units during construction. These pre-sales can significantly reduce financial risk by generating early capital inflows and demonstrating demand to lenders. Once units are sold, developers may exit the project entirely, allowing investors or individual owners to manage the property thereafter.

Hotel developments follow a different investment model. Instead of selling individual rooms, developers typically retain ownership of the entire asset and generate returns through ongoing operations. The long-term success of a hotel, therefore, depends not only on construction quality and location but also on branding, operational performance and market demand. This ongoing operational exposure distinguishes hotel development from many residential real estate projects.

Risk Profiles Across CRE Sectors

Each commercial real estate sector has its own distinct risk structure, shaped by the economic forces that drive demand and the asset’s operational characteristics. Understanding these differences is central to evaluating hotels versus CRE sectors, because the sources of risk vary significantly between leased property investments and operating real estate. Hotels face risks primarily linked to demand volatility and operational performance. Occupancy levels, room pricing and overall revenue can fluctuate rapidly in response to economic cycles, travel patterns, geopolitical events or shifts in tourism flows. At the same time, hotel performance depends heavily on management quality, brand positioning and the effectiveness of revenue management strategies, meaning that operational execution plays a central role in financial outcomes.

Traditional CRE sectors face different types of exposure. Office buildings are often vulnerable to tenant concentration and macroeconomic cycles, particularly where a property depends on a small number of major corporate occupiers. Retail property risks tend to centre on tenant stability and changing consumer behaviour, with shopping centres especially sensitive to anchor tenant departures and structural shifts in retail patterns. Industrial real estate generally carries lower operational complexity but can be affected by tenant relocation, evolving logistics networks and changes in transportation infrastructure that alter distribution patterns.

Residential property, while supported by the fundamental demand for housing, is not without risk. Investors must navigate tenant protections, rent control policies and regulatory frameworks that can affect income growth and asset management flexibility. When viewed together, these sector-specific risks illustrate why real estate investment decisions depend not only on location and development cost but also on the broader demand drivers and regulatory environments influencing each asset class. Understanding these differences helps investors position hotels within the wider CRE landscape and assess where hospitality assets may offer both greater operational complexity and the potential for higher revenue upside.

Further resources:

See also:

- HotelDevelopmentGuide.com – Compatible CRE: Strategic Alignment

- HotelDevelopmentGuide.com – The Advantages of Hotel Development

- HotelDevelopmentGuide.com – The Challenges of Hotel Development

- HotelDevelopmentGuide.com – Investor Motivations to Build a Hotel

SIG Insider (September 2025) – “Why You Should Invest in Hotels Right Now”

^^^Return to Top of Page^^^